20, Minnesota owned and operated businesses that can demonstrate financial hardship due. Refer to B3-4.3-03, Retirement Accounts, for the requirements pertaining to the use of retirement accounts for the down payment, closing costs, or reserves. Main Street COVID Relief Grants Program opens Sept. If more than 30 percent of a borrowers income is rental income, how much, if any, of that rental income can be used to qualify. When used for reserves, 100% of the value of the assets (as determined above) may be considered, and liquidation is not required. The Single-Family Seller/Servicer Guide (Guide) states that a borrowers rental income from their one-unit primary residence cant exceed 30 percent of the total income used to qualify for a Home Possible mortgage. Otherwise, evidence of the borrower’s actual receipt of funds realized from the sale or liquidation must be documented. When used for the down payment or closing costs, if the value of the asset (as determined above) is at least 20% more than the amount of funds needed for the down payment and closing costs, no documentation of the borrower’s actual receipt of funds realized from the sale or liquidation is required.

Freddie mac requirement for business funds used for down payment mac#

The type of assistance provided depends upon the conventional first mortgage loan type as shown below: Freddie Mac HFA Advantage amount of assistance is 0, 3.5, or 4.0 of the total first mortgage loan amount, determined by the participating lender. The value of government bonds must be based on their purchase price unless the redemption value can be documented. The down payment assistance is based on a percentage of the total first mortgage loan amount.

Effective for mortgages with Freddie Mac settlement dates on and after July 1, 2020.

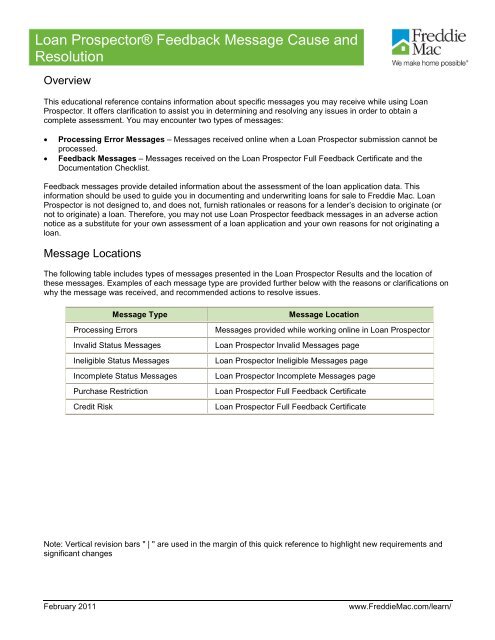

Gift funds may fund all or part of the down payment, closing costs, or financial reserves subject to the minimum borrower contribution requirements. Notes: A vertical revision bar ' ' is used in the margin of this quick reference to highlight new requirements and significant changes. The Use of Gift Funds 5 A borrower of a mortgage loan secured by a principal residence or second home may use funds received as a personal gift from an acceptable donor. Note: Non-vested stock options are not an acceptable source of funds for the down payment, closing costs, or reserves and should not be entered on the loan application. rental income is not used to qualify the borrower, the requirements of Chapter 5306.1 do not apply.

0 kommentar(er)

0 kommentar(er)